tax break refund tracker

Social Security number of taxpayer. Another way is to check your tax transcript if you have an online account with the IRS.

If its more convenient than the website you can also check your tax refund status using the IRS2Go app which is available on the Amazon Appstore Apples App Store and the Google Play store.

. Use the Wheres My Refund tool or the IRS2Go mobile app to check your refund online. How to track and check its state The tax authority is in the process of sending out tax rebates to over 10 million Americans who incorrectly paid. 22 hours agoBy JEFF AMY 2 hours ago.

How to calculate your unemployment benefits tax refund. Data from March 11 shows the IRS has processed 619 million returns and issued 453 million refunds worth some 15193 billion. As of March 4 most recent data available nearly 38 million tax refunds worth more than 129 billion have been issued in 2022.

See refund delivery timelines and find out. The Internal Revenue Service is reporting the average tax refund at least so far in the 2022 filing season is up over last year. Generally the IRS issues most refunds in less than 21 days but some may take longer.

Use the IRS2Go app for refund updates. The systems are updated once every 24 hours. Taxpayers are issued refunds for the amount of money they overpaid within that tax year.

Check For the Latest Updates and Resources Throughout The Tax Season. Meanwhile some taxpayers end up owing money to the IRS after filing their taxes because they underpaid throughout the year. Its taking more than 21 days for IRS to issue refunds for certain mailed and e-filed 2020 tax returns that require review And in some cases this work could take 90 to 120 days.

10200 x 2 x 012 2448. The average refund so far this year is 3401 which is a 137. How to Check the Status of Your Refund What youll need.

How to claim an unemployment tax refund and how to check the IRS payment status The American Rescue Plan provided a significant tax break for those who received unemployment. IRS unemployment refund update. You can call the IRS to check on the status of your refund.

To check the status of your 2021 income tax refund using the IRS tracker tools youll need to provide some personal information. To check the status of your 2021 income tax refund using the IRS tracker tools youll need to provide some personal information. Households whove filed a income tax return and are due a refund get an average of 2900 back - we explain how to track down the cash.

This is the fastest and easiest way to track your refund. However IRS live phone assistance is extremely limited at this time. Please allow 2-3 weeks of processing time before calling.

So our calculation looks something like this. The IRS app has several uses beyond checking your refund status but if thats all you need to do select the refund tab and. When do we receive this unemployment tax break refund.

Wheres My Tax Refund a step-by-step guide on how to find the status of your IRS or state tax refund. Methodology Each tax season millions of US. Exact amount of the refund.

This is available under View Tax Records then click the Get Transcript button and choose the federal tax option. The measure gives refunds of 250 to 500 to people who filed tax returns for 2020 and 2021. Those who file an amended return should check out the Wheres My Amended Return.

Last month frustrated taxpayers spoke out over tax refund delays after the IRS announced the unemployment tax break cash. Taxpayers on the go can track their return and refund status on their mobile devices using the free IRS2Go app. After more than three months since the IRS last sent adjustments on 2020 tax returns the agency finally issued 430000 refunds on Monday to those who qualify for the unemployment tax break.

Your Social Security number or Individual Taxpayer Identification. Use TurboTax IRS and state resources to track your tax refund check return status and learn about common delays. The American Rescue Plan Act enacted on March 11 2021 provided relief on federal tax on up to 10200 of unemployment benefits a taxpayer had collected in 2020This tax break was applicable for.

This is only applicable only if the two of you made at least 10200 off of unemployment checks. SmartAsset analyzed data from the IRS to determine the counties where people received the highest average tax refunds. Brian Kemp signs a bill to give state income refunds of more than 11 billion on Wednesday March 23 2022 at the Georgia capitol in Atlanta.

Which is designed to people track the status of their tax refund. After this you should select the 2020 Account Transcript and scan the transactions section for any entries as Refund issued. TAX SEASON 2021.

For the latest information on IRS refund processing see the IRS Operations Status page. The average refund so far this year. When you submit your information you can.

IRS TAX REFUND. Two ways to check the status of a refund. To reiterate if two spouses collected unemployment checks last year they both qualify for the 10200 tax break.

The 10200 is the amount of income exclusion for single filers not the amount of the refund. Any people in the United States will have already been sorting their 2021 tax return but there are some citizens who are still waiting for their 2020 tax refund. Heres How to Track Your Tax Refund.

The IRS has estimated that up to 13 million Americans may qualify for the tax break. By telephone at 317-232-2240 Option 3 to access the automated refund line. Refund for unemployment tax break.

The child tax credit checks began going out in july and will continue monthly through december for eligible families. Ad Learn About the Common Reasons for a Tax Refund Delay and What To Do Next.

Myjh Dashboard Tax Refund Accounting Status

Tax Refund Chart Can Help You Guess When You Ll Receive Your Money In 2021

How To Find Out Your Tax Refund Status Tax Refund Irs Taxes Tax

Irsnews On Twitter Tax Refund Tax Time Tax Help

Time To File Your Taxes And Get Your Refund Check Check Out These Great Options For Filing Your Taxes Free And Ideas Tax Refund Finance Debt Tax Deductions

Here S How To Track Your Tax Refund Nasdaq

Why Tax Refund Is Important For Everyone Income Tax Return Tax Refund Income Tax

21 Tax Deductions Business Owners Need To Know Business Tax Deductions Tax Deductions Small Business Tax

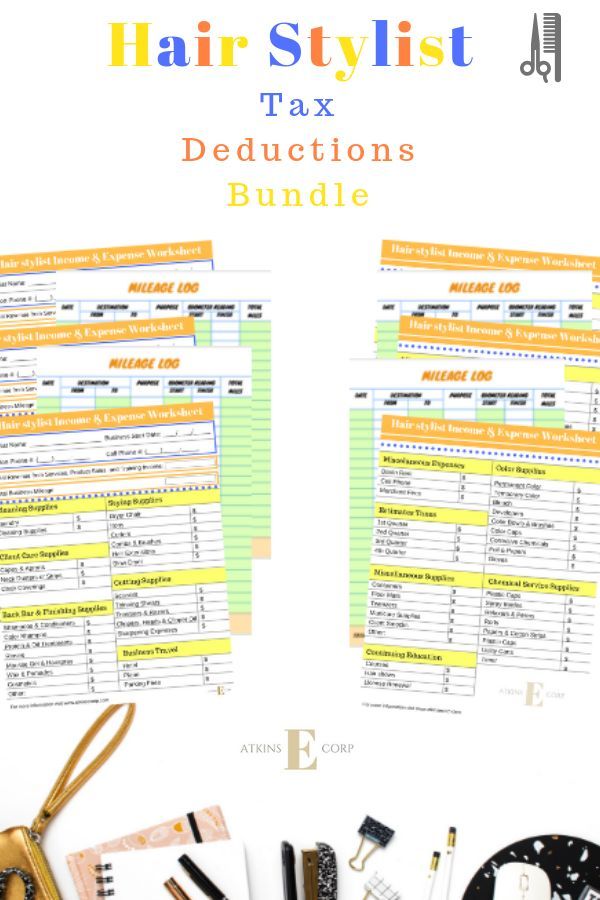

Hair Stylist Income And Expense Ultimate Bundle Atkins E Corp Hair Stylist Income Tax Printables Hair Stylist

Rental Income And Expense Worksheets Atkins E Corp Being A Landlord Rental Income Business Tax

How To Get Your Stimulus And Tax Refund Fast Nextadvisor With Time

4 Steps From E File To Your Tax Refund The Turbotax Blog

Tax Return Refund Delays From The Irs Leave Triangle Residents Waiting For Thousands Of Dollars Abc11 Raleigh Durham

Tax Refund Chart Can Help You Guess When You Ll Receive Your Money In 2021

Income Tax Return E Filing E Filing Income Tax Returns Trutax Income Tax Return Tax Return Income Tax

Pin By Alicia Hunt On Budgeting Tax Prep Checklist Tax Prep Small Business Tax

Stay Organized And Tax Ready With The Itemized Medical Expense Worksheets The Medical Expens Medical Expense Tracker Expense Tracker Printable Expense Tracker

Irs Tax Refund Calendar 2022 When To Expect My Tax Refund

Company Registration For Startup Startup India E Filing Services On Trutax Income Tax Tax Return Income Tax Return